Technology Architecture

Advanced technology architecture based on the Tron blockchain, ensuring investment transparency, security and automated execution

Data Flow Model (DFM) Strategy

Core Strategy Architecture

Our DFM strategy is based on a trading system that integrates order book data, on-chain data, and trading behavior algorithms. Using big data and market capital flow foundation models, we monitor the top 20 cryptocurrencies that account for 90% of liquidity to gain insights into trend directions and position management strategies for trading.

Trading Pairs

Including BTC, ETH, DOGE, SOL, ADA... and other top 20 mainstream cryptocurrencies

Exchanges

Primarily trading on top-tier exchanges such as Binance and Bybit

Data Flow Underlying Logic

Long-term Factors

Factors affecting external capital inflow and outflow to/from the crypto market, determining whether unidirectional "trend markets" form

- • ETF Capital Flow

- • USDT/USDC On-chain Data

- • Institutional Holdings

- • CME Smart Money

- • Bitfinex Whale

Short-term Factors

The main drivers of short-term market movements are "high leverage clearing" of contract players, forming "volatile markets"

- • Spot/Contract Order Book Depth

- • Weighted Order Book Depth

- • Contract Funding Rate

- • Funding Rate

- • Orderbook Dif

Main Force Cost Factors

Through proprietary algorithms, standardized calculation of main force pump and dump cost ranges

- • Order Book Ratio Standardization Indicator

- • Main Force Cost Range Analysis

- • Position Change Behavior Monitoring

- • External/Internal Capital Flow Calculation

Algorithm Standardization Technology

Technical Advantages

Through multiple moving average (EMA) crossovers and custom signal indicators, our algorithms can standardize trading signals under different market conditions, effectively identifying market trend turning points and optimal entry timing.

Signal Indicator Parameters

* Custom parameter combination optimized through extensive backtesting

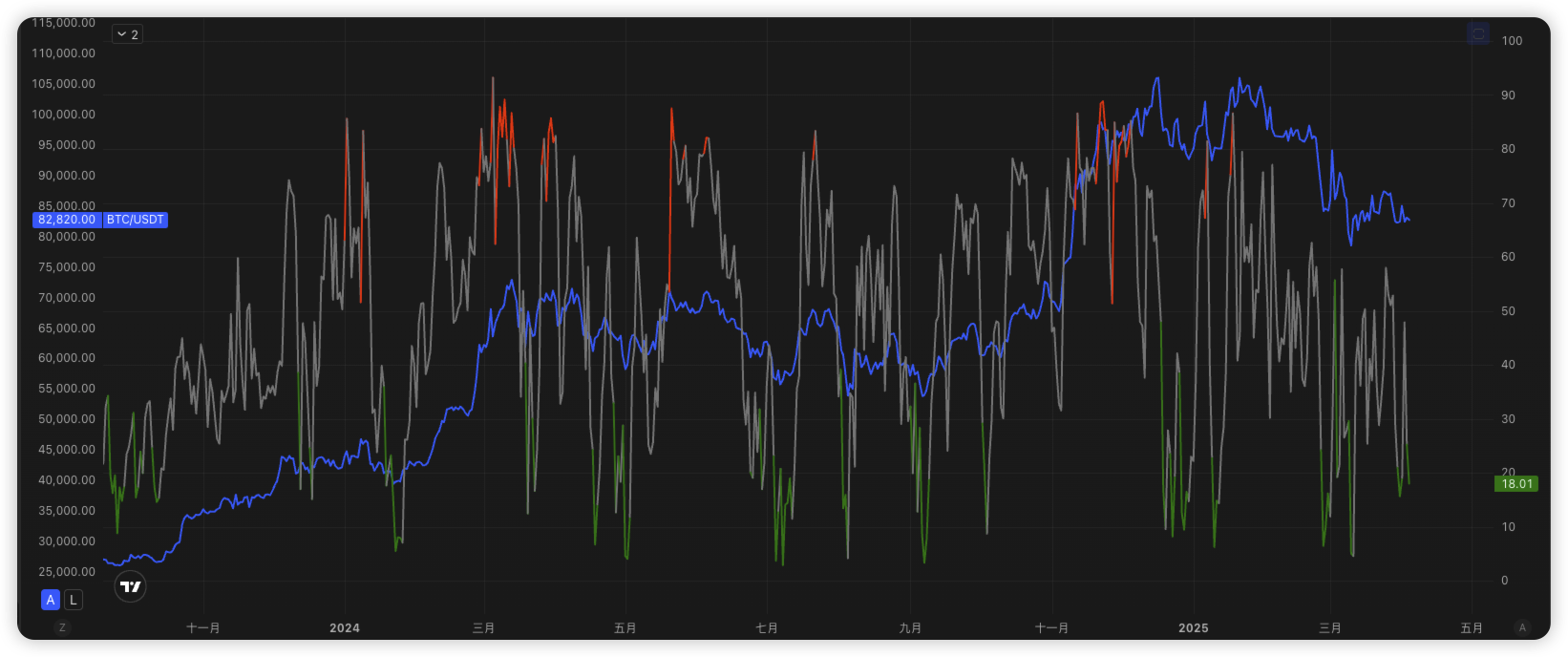

Strategy Analysis Charts

Long-term Factors Performance

CME Smart Money: Institutional large holder position changes

Bitfinex Whale: Large holder capital flow monitoring

Stablecoin Supply: Stablecoin supply changes

Short-term Factors Monitoring

Funding Rate: Contract funding rate monitoring

Orderbook Depth: Order book depth analysis

Volatility Index: Volatility index tracking

Strategy Advantages Display

Strategy vs Benchmark Performance Comparison

Key Metrics

Technology Stack

Tron Network

High-performance blockchain network supporting USDT TRC-20

Smart Contracts

Automated execution of investment logic and profit distribution

Multi-Sig Wallets

Multi-signature wallets ensuring fund security

Real-time Analytics

Real-time data analysis and risk monitoring system

System Architecture

Blockchain Layer

Tron Network

- • TRC-20 USDT Smart Contract

- • Multi-Signature Wallets

- • Decentralized Transparency

Smart Contract Layer

Investment Logic

- • Automated Investment Execution

- • Profit Distribution Mechanism

- • Risk Control Logic

Application Layer

User Interface

- • Web3 Wallet Connection

- • Real-time Data Display

- • User-friendly Interface

Security Features

Multi-Signature Protection

All fund transfers require multiple key signature confirmations, preventing single point failures and malicious attacks

Smart Contract Audit

All smart contracts undergo comprehensive audits by third-party security companies, ensuring code security without vulnerabilities

Hot/Cold Wallet Isolation

Large amounts stored in offline cold wallets, only small amounts used for daily trading operations

Real-time Risk Monitoring

24/7 around-the-clock risk monitoring system, automatically pausing abnormal transactions and sending alerts